7 most common accounting mistakes Lithuanian entrepreneurs make and how to avoid them (0)

Many business owners in Lithuania make common accounting mistakes that can lead to cash flow issues, tax problems, and even legal penalties. Fortunately, with the right tools and knowledge, you can avoid these pitfalls. In this post, we’ll highlight the most common accounting mistakes Lithuanian entrepreneurs make and how SimplBooks can help you avoid them.

1. Failing to track expenses properly

One of the biggest mistakes entrepreneurs make is neglecting to accurately track all business expenses. It might seem easy to lose receipts, forget to document small purchases, or mix personal and business expenses, but these habits can quickly lead to confusion and incomplete financial records.

How to avoid it:

- Keep all receipts, invoices, and records of business-related expenses.

- Use an organized system to categorize expenses, such as travel, office supplies, or marketing.

SimplBooks solution:

SimplBooks helps you keep accurate track of all expenses by allowing you to easily categorize and document each transaction. You can upload receipts directly into the system, making expense tracking seamless and ensuring everything is accounted for at tax time. Additionally, you can integrate CostPocket, which allows you to snap photos of your receipts on the go and automatically upload them into SimplBooks. This integration eliminates the hassle of manual data entry and ensures that no expense is missed, making expense tracking faster and more efficient.

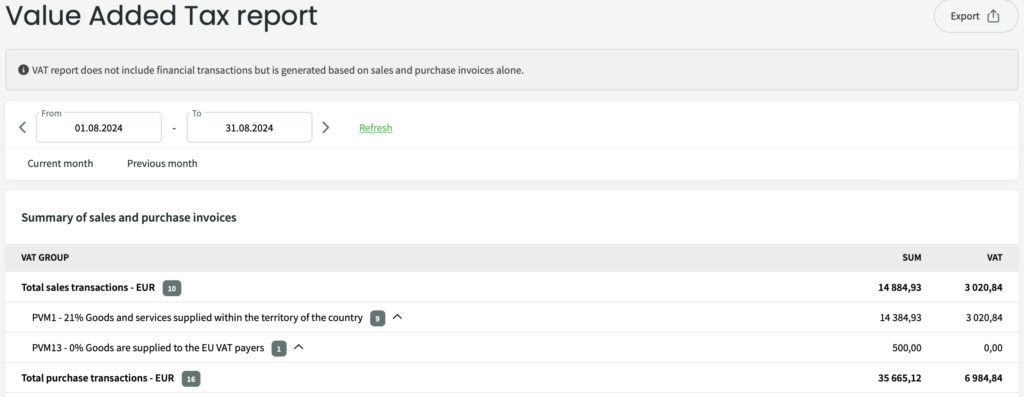

2. Incorrectly managing VAT

In Lithuania, VAT (Value-Added Tax) is a significant part of business accounting. Many entrepreneurs struggle with calculating and filing VAT correctly, leading to underpayments or overpayments. Incorrect VAT management can result in fines and penalties from tax authorities.

How to avoid it:

- Ensure you understand Lithuania’s VAT regulations and rates.

- File VAT returns on time and double-check your calculations before submitting.

SimplBooks solution:

SimplBooks simplifies VAT management by automatically calculating VAT based on the transactions you enter. The system generates accurate VAT reports, ensuring compliance with tax authorities and reducing the risk of errors.

3. Not keeping up with financial reporting

Entrepreneurs are often too focused on daily operations to prioritize financial reporting, which can lead to problems when it’s time to file taxes or apply for a loan. Without regular financial reports, it’s difficult to see the big picture of your business’s health.

How to avoid it:

- Set aside time each month to review your financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

- Use these reports to assess how your business is performing and to make informed decisions.

SimplBooks solution:

SimplBooks generates real-time financial reports, giving you instant access to key metrics like profit margins, cash flow, and account balances. These reports help you stay on top of your financial health and make informed decisions for the future.

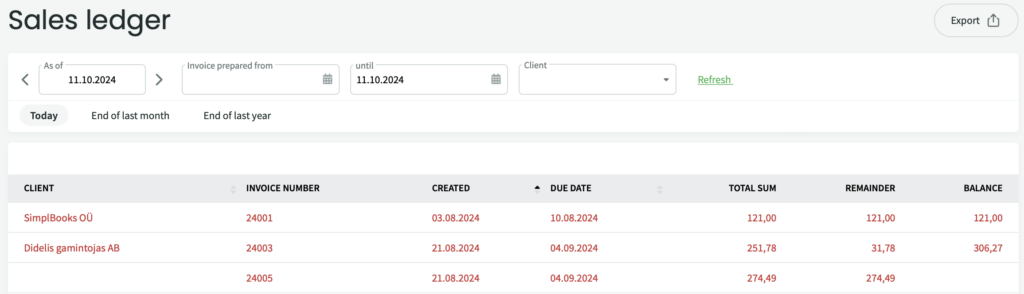

4. Inconsistent invoicing practices

Another common mistake is inconsistent or delayed invoicing. Failing to send out invoices on time or neglecting to follow up on unpaid invoices can severely impact your cash flow. Entrepreneurs who rely on manual invoicing processes often miss important details or overlook payment deadlines.

How to avoid it:

- Create and send invoices as soon as a product is delivered or a service is rendered.

- Set up a system for tracking unpaid invoices and sending reminders.

SimplBooks solution:

SimplBooks allows you to create and send professional invoices instantly. You can set up automatic reminders for overdue invoices, helping you get paid faster and maintain healthy cash flow. The system also provides an overview of all outstanding payments in one place.

5. Misclassifying income and expenses

Accurately categorizing income and expenses is essential for proper accounting. Misclassifications can lead to incorrect financial reports and tax filings, which may cause you to overpay or underpay your taxes.

How to avoid it:

- Make sure every transaction is classified correctly, whether it’s income from sales, loans, or capital contributions.

- Seek professional advice if you’re unsure how to classify certain transactions.

SimplBooks solution:

With SimplBooks, you can easily categorize income and expenses using predefined categories. The system ensures that all transactions are properly classified, minimizing the risk of errors and ensuring accurate tax filings.

6. Ignoring cash flow management

Many entrepreneurs overlook cash flow, focusing only on profitability. However, even if your business is profitable on paper, poor cash flow management can lead to serious issues like an inability to pay bills or purchase necessary supplies.

How to avoid it:

- Monitor your cash flow regularly to ensure you have enough liquidity to cover your expenses.

- Make cash flow projections to prepare for seasonal changes in your business.

SimplBooks solution:

SimplBooks provides you with real-time cash flow reports, so you can track the movement of cash in and out of your business. This allows you to spot any potential cash flow problems early and take action to avoid them.

7. Failing to reconcile accounts regularly

Reconciling your accounts—matching your bank statements with your business’s financial records—is a crucial step to ensure accuracy. Failing to do this regularly can result in discrepancies that are hard to fix later on.

How to avoid It:

- Schedule regular account reconciliations, ideally at the end of each month.

- Compare your bank statements with your business’s financial records to catch any discrepancies.

SimplBooks solution:

SimplBooks offers a built-in reconciliation feature that makes it easy to match your financial records with your bank statements. This helps you identify and resolve discrepancies quickly, ensuring accurate and up-to-date financial records.

Accounting mistakes can have serious consequences for Lithuanian entrepreneurs, from financial losses to legal penalties. However, by being aware of these common pitfalls and using reliable accounting software like SimplBooks, you can ensure your business’s finances are well-managed and compliant with Lithuanian regulations.

More automated accounting for your company!

A more advanced and easy accounting software SimplBooks with over 20,000 active users – register an account and you can try 30 days free (no credit card needed). Or try our demo version!

Leave a Reply